Acquiring a cash advance is highly recommended a worst circumstance. You have to be sure that you completely grasp the direction they function. Moreover, you should recognize every one of the service fees connected with payday loans no credit check (wiki-se.com.br) loans. Please read on for more information about online payday loans and the way to obtain the most well informed judgements about pay day loans.

Don’t simply hop in a car and drive to the nearest payday advance financial institution to acquire a connection financial loan. Examine your whole location to get other payday advance businesses that might provide better charges. A concise little analysis can lead to massive price savings.

If you realise yourself saddled with a cash advance that you just cannot pay back, call the financing company, and lodge a issue. Most people genuine complaints, concerning the substantial costs incurred to increase payday loans for an additional spend time. Most financial institutions gives you a deduction on your own financial loan costs or attention, however, you don’t get in the event you don’t question — so make sure you question!

Be aware of the deceiving charges you will be introduced. It may look to be inexpensive and satisfactory being billed fifteen dollars for each a single-hundred or so you obtain, but it really will rapidly accumulate. The prices will translate to become about 390 pct of the amount obtained. Know exactly how much you will be required to pay out in costs and fascination in the beginning.

Service fees that are bound to payday loans incorporate numerous kinds of service fees. You have got to discover the interest quantity, fees service fees and if there are actually software and processing charges. These fees will vary in between distinct loan companies, so make sure to check into diverse loan providers prior to signing any arrangements.

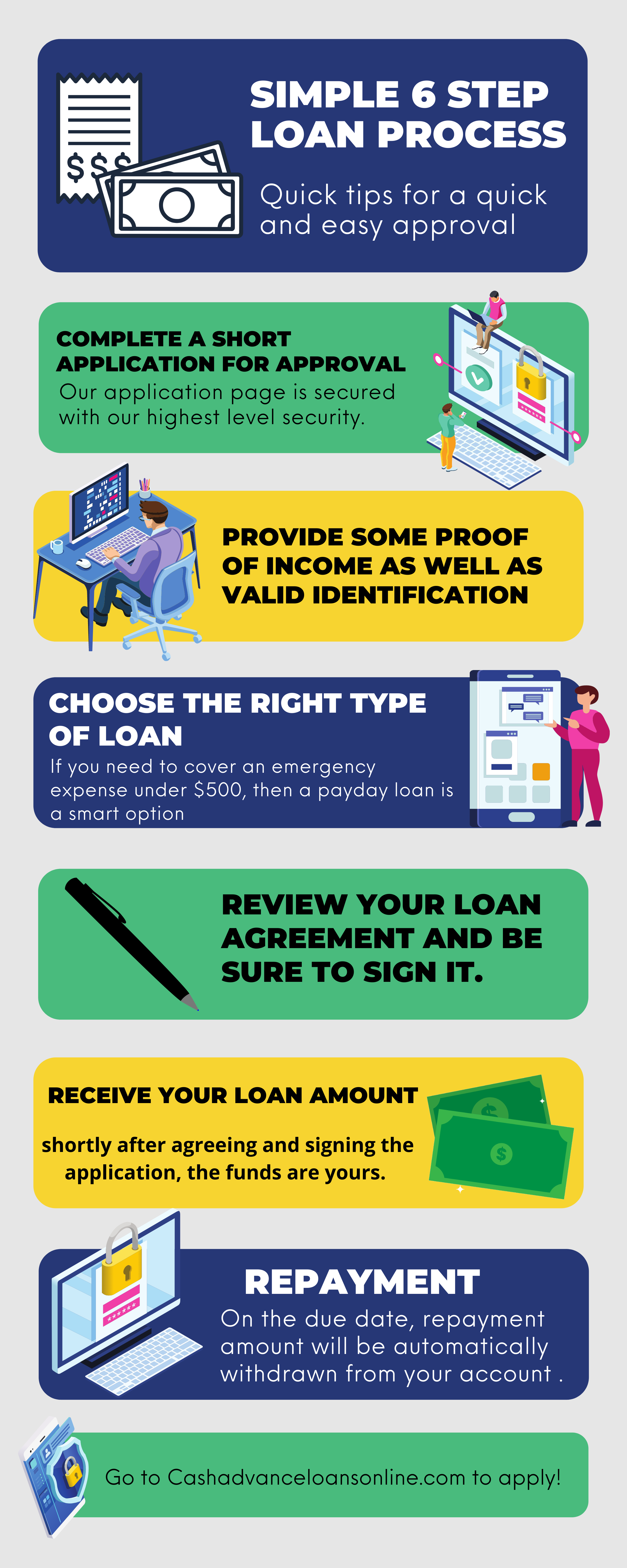

Usually go through every one of the stipulations involved in a pay day loan. Determine each point of monthly interest, what each and every possible fee is and how very much each one is. You want an urgent situation fill bank loan to help you get out of your existing conditions straight back to in your toes, however it is easier for these situations to snowball over numerous paychecks.

When dealing with pay day loan providers, usually find out about a payment discount. Business insiders show that these particular lower price fees really exist, only to people that find out about it purchase them. Even a marginal discount could help you save funds that you will do not have right now in any case. Even though they say no, they may point out other bargains and options to haggle for your personal business.

An excellent idea for everyone searching to get a payday loan would be to prevent supplying your information to financial institution matching web sites. Some cash advance websites complement you with creditors by expressing your data. This can be quite dangerous as well as steer to many junk e-mail email messages and unwanted phone calls.

Usually do not get a loan for any more than you can pay for to pay back in your next pay out period of time. This is an excellent strategy to enable you to shell out your loan way back in complete. You may not desire to shell out in installments as the fascination is very substantial that this will make you are obligated to pay a lot more than you lent.

Make sure you have a shut eye on your credit track record. Make an effort to check out it a minimum of annually. There might be irregularities that, can severely damage your credit score. Having bad credit will negatively affect your rates on your own cash advance. The greater your credit score, the less your interest rate.

The very best suggestion readily available for using payday loans is always to never need to utilize them. If you are being affected by your bills and are unable to make stops meet up with, pay day loans are not how you can get back in line. Consider making a budget and conserving some cash so that you can stay away from these sorts of loans.

When the loan is timetabled for settlement, be sure you have the cash offered in your money. You possibly will not use a dependable income source. If conditions come up and your deposit will not be manufactured, additional fees are sure to be assessed.

If you find yourself within a situation with numerous payday loans, usually do not make an effort to combine them in to a larger sized bank loan. Once you can’t even pay the personal loans themselves, you won’t be able to pay off the greater financial loan possibly. See if you can spend the money for loans through the use of decrease rates. This will let you get out of financial debt more rapidly.

For people with examined a bunch of their alternatives and possess decided that they have to work with an urgent payday loan, be described as a wise consumer. Perform a little research and select a pay day loan company that provides the best rates and charges. Whenever possible, only obtain whatever you can afford to repay with the up coming paycheck.

When you are seeking to make a decision if you should obtain a payday loan, you need to browse the details provided that will help you opt for. You will discover the best costs and make much more knowledgeable selections. Before making any selection, take your time.